E Filing Borang B Due Date 2018 Malaysia

31st august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income.

E filing borang b due date 2018 malaysia. Grace period is given until 15 may 2019 for the e filing of form be form e be for year of assessment 2018. Selangor malaysia lembaga hasil dalam negeri malaysia bahagian pengurusan rekod maklumat percukaian jabatan operasi cukai menara hasil no. Pemberhentian pengeluaran sijil taraf orang kena cukai stokc mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019.

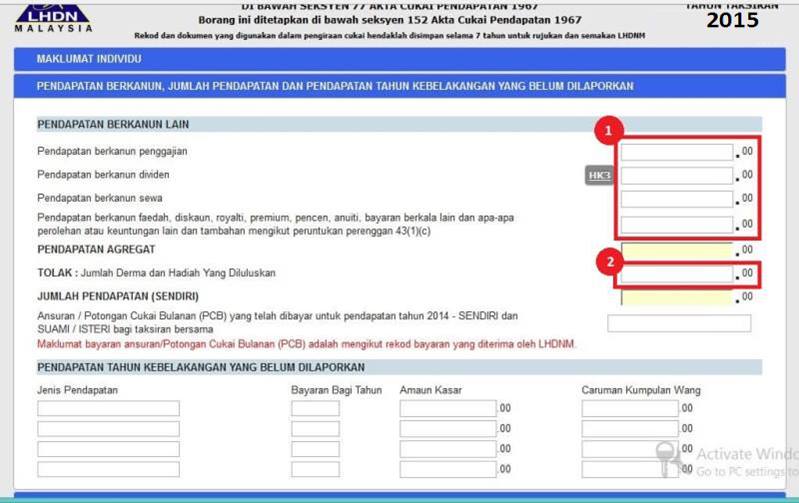

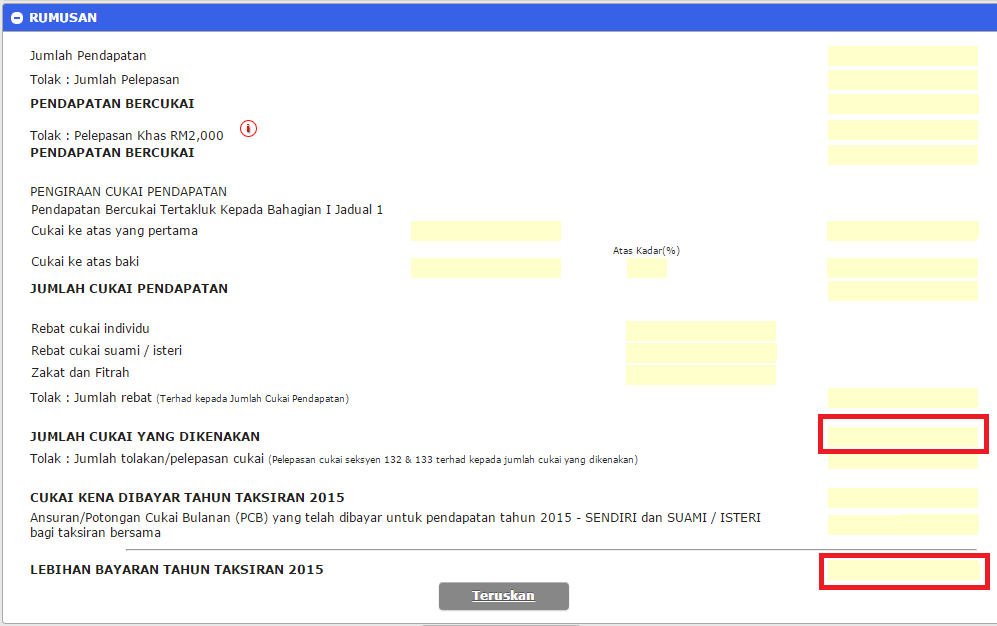

2018 lembaga hasil dalam negeri malaysia return form of a individual on business. Please access via https ez hasil gov my. 1 due date to furnish this form. Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who carry on a business.

8 for further information please contact hasil care line 800 88 5436 lhdn calls from overseas. 31 march 2019 a form e will only be considered complete if c p 8d is submitted on or before 31 march 2019. If you have never filed your taxes before on e filing income tax malaysia 2019. You can see the full amended schedule for income tax returns filing on the lhdn website.

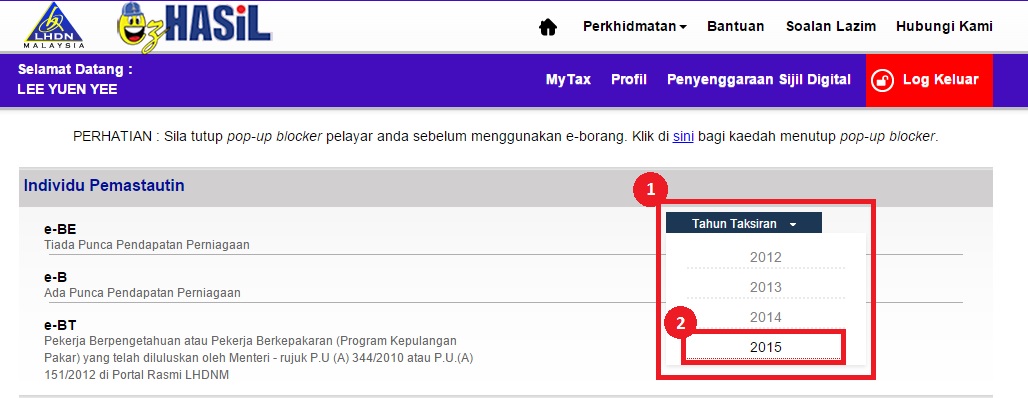

3 jalan 9 10 seksyen 9 karung berkunci 222 43659 bandar baru bangi selangor malaysia taxpayers and employers which are companies are compulsorily required to submit form c and form e via e filing. Sepanjang sesi penyenggaraan ini semua aplikasi e filing m filing taef e bas e kemaskini e spc dan e lejar tidak dapat dicapai. To begin filing your tax click on e borang under e filing. Remember you file for 2018 income tax in 2019.

7 the use of e filing e b is encouraged. Employers who have e data praisi need not complete and furnish c p 8d. Here is a list of income tax forms and the income tax deadline 2019. 1 tarikh akhir pengemukaan borang.

Majikan yang aklumat melalui e data praisi tidak perlu mengemukakan borang c p 8d. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. You will be shown a list of features available on e filing. 10 paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving malaysia.

603 77136666 b 2018 year of assessment form cp4a pin. The due date for submission of form be for year of assessment 2018 is 30 april 2019.